Applying the power of AI to the retail fuel industry

Last update: Apr 28, 2025

Advertorial

Discover how AI is transforming fuel retail pricing strategies—helping operators optimize margins, predict demand, and stay competitive in a fast-changing market.

The Shifting Landscape of Retail Fuel

These days, it feels like you can't have a conversation without someone dropping the term ‘AI.’ It’s the ultimate buzzword.

However, AI isn’t just hype, and we can see its impact in medicine, autonomous driving or large language models. But it is also already bringing real, practical value to the fuel industry, especially at a time when the landscape is shifting.

Declining fuel demand due to vehicle fuel efficiency, the rise of electric vehicles and remote work means fuel retailers must rethink their strategies. The traditional playbook—competing aggressively on price to gain volume—is no longer sustainable.

To stay profitable and relevant, retailers must shift focus toward margin protection and market share optimization. This is where AI steps in. By enabling predictive, data-driven decisions, AI is reshaping how fuel retailers operate. This article explores how AI is being used today in the retail fuel industry, backed by real-life examples and our experience with PriceCast, the AI-driven price optimisation software developed by A2i, which is now part of OPIS, a Dow Jones company.

The Increasing Complexity of Fuel Pricing

Decades ago, when there was an attendant at the pump, there was a real connection with the customer, providing instant feedback about the product, service, and most importantly, pricing. With technological advancements, that connection has been lost, as people now use digital payment methods, visit unmanned sites and may not even enter the store – if it hasn’t already been replaced by self-service kiosks.

Despite the changing customer experience, the critical question remains: what is the sweet spot that optimizes fuel prices in line with the retailer's strategy?

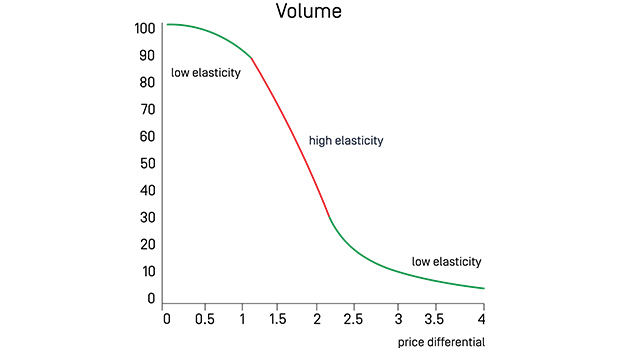

Basic economic theory suggests that as price increases, volume and market share tend to decrease. However, the demand curve is more complex. Some zones of pricing show low elasticity, where price changes have minimal impact on volume. Other zones are highly elastic, where minor changes can cause significant shifts in demand.

Retailers may aim for a specific market share while looking to protect or even increase margin—or vice versa. But setting the right price across a network is far from easy. With hundreds of thousands of stations, carrying multiple products, each with its own elasticity profile, local competitors, fluctuating demand, different loyalty programs being launched, and a mix of fuel and in-store sales, the challenge quickly becomes very complex.

From Cost-Driven to Competitor-Centric to Consumer-Centric Optimization

To cope with this complexity, some fuel retailers use a cost-driven approach, adjusting prices to ensure margins stay above a defined target. While there is some degree of automation, these systems offer limited ability to respond to market volatility, as prices typically change only when the station’s tank is refilled.

Other retailers adopt a more sophisticated, rule-based pricing method. They create rules primarily based on their perceived competitors while still maintaining target margins. These rules might include: “I want to be the cheapest in the area”, “I want to stay 1 cent below the leader”, “I want to avoid being more than 2 cents above this or that competitor.”

Rule-based pricing is inherently competition-centric. It enables more frequent price changes, but it remains reactive rather than proactive. While operationally simple, it overlooks customer behaviour and station-specific performance.

But what if we could understand customer sentiment in real time—just like the old station attendant used to, intuitively?

Enter Artificial Intelligence.

Artificial intelligence has increasingly been in the spotlight over the past two years, as generative systems using large language models have become familiar to the public through impressive chatbot platforms such as ChatGPT. These recent advancements have been particularly boosted by the use of neural networks.

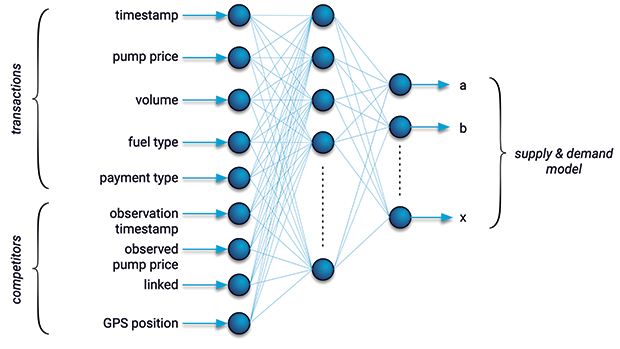

Neural networks are a kind of artificial intelligence which can learn from massive input data and identify patterns that can be used for optimization purposes. They are commonly used in medical imaging, facial recognition, algorithmic financial trading, etc. but also in predictive pricing models.

In the case of fuel stations, they can be trained on historical transaction data, prices, volumes, observed public gas prices, weather, traffic, cellular ping data, etc.. They can learn how customers behave, forecast customer demand and price elasticity, and suggest prices for each product and station. Unlike rigid rule-based systems, AI is adaptive, predictive, and customer-centric. It is also self-learning, which makes it faster and easier to manage as it continuously improves its accuracy and efficiency over time.

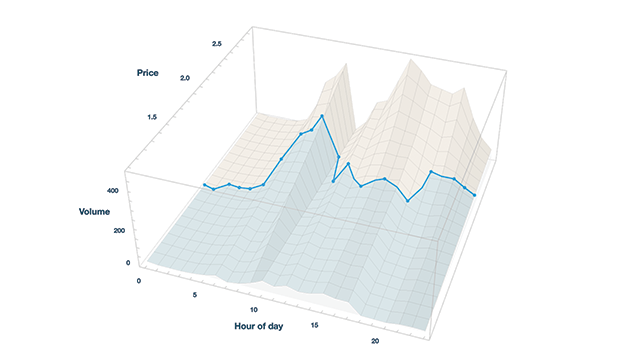

As shown in the graph below, an AI engine can for example forecast the next 24 hours in terms of demand and elasticity and calculate a price that reasonably balances the objectives and constraints of the fuel retailer.

With such a system, pricing managers are no longer pricing “in the blind” leaving volumes or margins on the table. Instead, they become strategic operators who set goals based on volume and margin budgets, review AI-driven recommendations, and retain full control over pricing decisions.

A software like PriceCast makes this shift possible by aligning corporate strategy with station-level execution. The software focuses on the tactics and allows pricing managers to focus on their KPIs. It proactively recognizes opportunities in the market. It automatically forecasts consumer price elasticity based on data correlations. And it automatically detects new market trends.

- Real-Life Example #1: AI Improving Margins in a Declining Market

A major European retailer used to update prices each morning based on the previous day’s data. With PriceCast collecting transactions directly from their stations, they began receiving updated data several times per day—saving time and capturing opportunities they previously couldn’t see. The pricing manager could then validate the prices and have them sent directly to the POS of its stations. The result: increased profitability, even as overall demand declined as well as significant improvement in efficiency. - Real-Life Example #2: AI Optimizing Fuel Prices by Combining Fuel & In-Store Sales

For a fuel retailer with significant C-store activity, we combined fuel data with convenience store data. Instead of optimizing prices based solely on transactions at the pumps, we also incorporated in-store transactions. The AI algorithm identified pricing levels that maximized both fuel volume and in-store spend, creating a holistic pricing approach. In practice, the algorithm focused on attracting customers who were most likely to make purchases inside the store after refueling. Outcome: station-level profitability increased significantly compared with the control group.

AI’s Broader Role in Fuel Retail Operations

AI can contribute far beyond pricing—enhancing operations, detecting issues, and reducing losses. At OPIS, we have used PriceCast to automatically detect pump failures and fuel fraud.

- Real-Life Example #3: Detecting Pump and Card Reader Failures

By monitoring live transaction patterns, AI can detect issues like faulty pumps or failing NFC readers before they are noticed by staff or customers. Deployed at a major fuel retailer, we showed that this proactive maintenance reduced downtime significantly, to such a degree that it was measurable on sold volumes, and improved customer experience considerably.

Another promising use case we are investigating is using PriceCast's advanced algorithms to process large datasets and uncover patterns that detect discrepancies between fuel volumes and transaction data. This would allow us to flag anomalies that could indicate potential skimming or fraud. By doing so, we would be able to detect these fraudulent activities early, helping fuel retailers identify and prevent revenue loss.

Overcoming the AI Skepticism: Guardrails and Human Oversight

When our clients evaluate our PriceCast AI software, their initial concerns tend to revolve around a few core themes.

First and foremost is data privacy and security—businesses want to know where their data is stored, who owns it, and whether it could be used to train external models. At OPIS, we make sure that the data is completely segregated from any other client and completely secured.

Another major concern is the reliability of the prices suggested by the AI, and how they can be trusted or “explained.” AI does not need to be a black box. Suggested prices come with explanations: the software can provide details regarding the elasticity and the demand, and insights on how it came to that specific value.

Last but not least, there is the concern of human control. With PriceCast, we make sure that the solution is fully configurable and built with human oversight by default. Pricing managers retain full control over strategy, constraints, and pricing decisions. AI provides the suggestions—humans stay in the driver’s seat.

The Future of AI in Fuel Pricing: What’s Next?

AI is no longer just a buzzword. It’s a strategic enabler.

Fuel retailers today face complex challenges: declining demand, tighter margins, and rapidly evolving customer behaviour. Traditional pricing tactics can’t keep up.

AI is becoming an essential tool in the retailer's toolbox to stay competitive in tomorrow’s market. In pricing, AI makes strategies predictive, adaptive, and aligned with real customer behavior—giving fuel retailers the tools they need to thrive.

Looking ahead, we expect AI to expand into broader retail roles, including customer segmentation and personalization, loyalty program optimization, and support for EV pricing.

With the rise of generative AI and emerging agentic technologies, we will continue to support retailers with advanced solutions that are intelligent, adaptive, and resilient by nature—enhancing their ability to manage the complex workflows of the future.

To learn more, visit our website!