Leading the open-loop transformation: The new strategic growth move for fuel retailers

Last update: Sep 18, 2025

Advertorial

Picafuel x Episode Six: A Turnkey Approach to Digitization, Control, and Scale

Outdated Systems Are Holding the Industry Back

Fleet card programs have long served as the backbone of fuel payments, designed for the needs of a different era. Today, however, issuers face a rapidly evolving environment- characterized by tighter margins due to improved fuel efficiency, the rise of electric vehicles, and customers shifting mobility habits. At the same time, business customers expect more: seamless contactless payments, mobile-first experiences, and integrated expense management.

Closed-loop card systems no longer deliver the flexibility or reach that business customers demand. They're mostly restricted to specific fuel networks, create operational silos, and make it harder for retailers to adapt quickly. For fleet card issuers, these limitations translate into lost revenue, higher complexity/costs, and weakened customer loyalty.

This moment presents a unique opportunity. By integrating open-loop, scheme-based solutions, fuel retailers and fleet card issuers can unlock greater flexibility, broader acceptance, and faster innovation. This evolution not only enhances operational efficiency but also strengthens customer loyalty and opens new revenue streams, without discarding the value of what’s already in place.

What's Changing in the Market

The fleet and fuel industries are evolving rapidly- and retailers must adapt to keep up.

These six trends are creating both pressure and opportunity:

- Fuel Revenue Is Shrinking

Improved fuel efficiency and the rise of EVs are reducing fuel volumes- and revenue. Fuel retailers need to diversify income sources beyond the pump, such as EV charging, tolls, and maintenance services. - Digital Payments Are the New Standard

Fleet customers expect the same seamless experience they get with personal finance: mobile-first, contactless, Apple / Google Pay, tap-and-go. Most closed-loop card programmes can’t meet these expectations. - SMEs Are Becoming the Core Customer

Small and mid-sized businesses now represent a major growth segment. They’re looking for simplicity: one card/ app that covers all business expenses- fuel, tolls, parking, travel, and more. - Fleet Operators Demand Real-Time Control

Employers want full visibility into spend- where, when, how much, and on what. Controlling misuse, enforcing policies, and preventing fraud are now must-haves. - Cross-Border Fleets Need Universal Solutions

International fleets need unified, scalable solutions that work across borders, without juggling different systems or card types by country. - Retailers Are Expanding Acceptance Channels

Fuel retailers are broadening payment acceptance to meet customer needs, capturing off-network spend like EV charging and tolls to create new value opportunities and stay top-of-wallet.

Fuel retailers who adapt early will be best positioned to capitalize on the shift in fleet payments.

The Open-Loop Opportunity

Open-loop fleet cards, connected to major networks like Visa and Mastercard, offer the reach of universal acceptance with the intelligence of advanced spend control. They unlock multi-category payments, from traditional fuel to tolls, corporate expenses, and travel, while giving you full visibility and control.

Why Open-Loop Makes Sense Now:

- Grow Revenue: Capture interchange from off-network spend.

- Reach New Segments: Attract SMBs, hybrid fleets, and solo professionals.

- Adapt to Mobility Trends: Support EV charging and emerging use cases to stay aligned with fleet demands.

- Enhance Loyalty: Drive usage by becoming a central daily tool.

- Modernize Efficiently: Launch faster, scale easier, without replatforming.

- Reduce operational / technology cost: Leverage modern-day technology to reduce unit costs.

The transition to open-loop networks is no longer theoretical - it’s underway. According to Mark Aquilina, Mastercard’s Global Transportation lead: “We’re seeing a clear inflection point in the fleet payments space. Established fleet card issuers are increasingly turning to open-loop networks to expand their reach, modernize and secure their customer experiences, and streamline operations. The flexibility and scale of these networks combined with modern processing platforms is unlocking new revenue streams while reducing costs- it’s a pivotal moment for the industry.” - Mark Aquilina, SVP, Mastercard.

Why Picafuel?

Picafuel is a SaaS fleet card issuance and management platform built specifically for the fuel retail and mobility industries. We help you digitize your fleet programs, issue and manage cards end-to-end, and prevent fraud in real time, while unlocking new revenue through smarter, more flexible payment models.

Originally focused on closed-loop systems, Picafuel has evolved to support scheme-based (open-loop) cards as well- empowering fuel retailers to run both models in parallel and transition seamlessly to a hybrid, future-ready strategy.

Picafuel gives you the flexibility to support closed-loop, open-loop, or hybrid models (combined open and closed-loop solutions on a single card) - all while applying your own spend rules and brand experience on scheme or proprietary closed loop cards. Combined with automated data feeds from the payment networks and receipt scanning, Picafuel can capture Level 3 data on every transaction, fuel or non-fuel, enhancing reporting, compliance, and visibility.

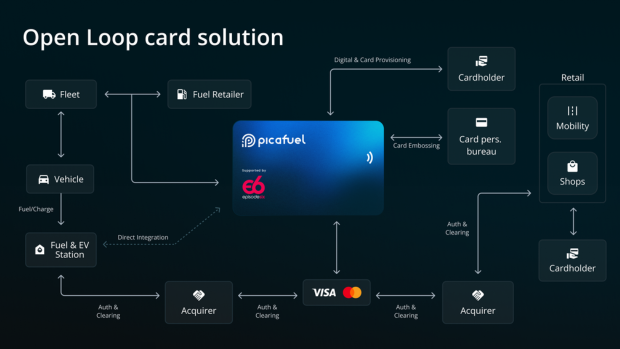

Our open-loop fleet card solution enables you to issue branded cards that are accepted anywhere scheme cards are used- fuel stations, EV charging, tolls, travel, and more. With Picafuel, you stay in control of usage, visibility, and compliance, while expanding your customer base and unlocking new business models.

Whether you're serving traditional fleets or targeting SMBs and mobile professionals, Picafuel helps you scale digitally, securely, and profitably, with flexibility, real-time control, and future-ready infrastructure.

Why Episode Six?

Episode Six is a global provider of payments infrastructure built to power the next generation of fleet card programs. Our cloud-native, API-first platform operates in 45+ countries and 16 AWS regions, giving issuers the scale and reliability needed to move beyond closed-loop limitations without risk. We deliver the backbone that ensures every transaction- fuel, EV charging, tolls, or travel- is processed securely, compliantly, and in real time.

For fuel retailers, Episode Six, in partnership with Picafuel, provides the flexibility to configure programs exactly the way you want them. Spend limits, merchant categories, driver rules, and fraud checks can all be updated instantly, without vendor bottlenecks or long development cycles. That same flexibility makes it possible to run closed-loop and open-loop programs side by side, giving you a smooth path to hybrid models and new revenue streams.

Episode Six also makes diversification simple. Whether you’re adding EV charging, expanding across borders, managing multiple currencies, or building loyalty programs tied to fleet behavior, our platform is designed to evolve with your strategy. Every feature is backed by enterprise-grade resilience and high availability uptime, so innovation never comes at the cost of stability.

The Picafuel + Episode Six Difference

Why not just any open-loop provider? Unlike generic payment platforms, Picafuel is purpose-built for the fleet industry. Our deep understanding of fleet operations, margin sensitivity, and compliance needs allows us to deliver a solution that’s not only flexible and scalable, but fully aligned with how fuel businesses actually run.

Together, Picafuel and Episode Six offer a streamlined, cloud-based turnkey solution- bringing open-loop fleet card programs to market faster, with less friction. This joint solution combines the scale of scheme-based cards with Picafuel’s deep control infrastructure, making open-loop feel as secure and tailored as a closed platform.

What Sets Us Apart:

- One Platform, Total Control: Define spend rules by merchant, product, location, driver, time, or amount- with real-time updates, plus full control over open-loop processing, compliance, and reporting.

- Instant Visibility: Monitor transactions, enforce policy, and prevent fraud in real time- all from a single dashboard.

- Seamless Program Management: Launch under your own brand. Manage onboarding, clearing, reporting, and analytics- all without third-party dependency.

- Enterprise-Level Flexibility: Issue one card that supports closed-loop, open-loop, and hybrid models- including T&E and corporate expense- while retaining full control over how and where it’s used.

- Level 3 Data Access: Capture detailed transaction data, on- or off-network, through POS integrations, scheme partnerships (Visa Fleet 2.0 / Mastercard MCF), or receipt scanning.

Together with Picafuel, Episode Six delivers the global payments infrastructure and network scalability, while Picafuel adds fleet-specific rules, branding, analytics, and customer experience management. The result is a single solution that’s powerful, compliant, and ready to scale.

From Payments to Loyalty: Expanding Share of Wallet

Open-loop isn’t just about flexibility; it’s about becoming a more essential part of the customer’s ecosystem. The more purchases go through your card, the more relevant and valuable you become.

With deeper insight into off-network behavior, you can:

- Deliver smarter loyalty programs

- Enable cross-merchant partnerships

- Personalize offers that drive retention

In short: more data, more relevance, more loyalty.

Conclusion: The Time to Act Is Now

The fleet card landscape is shifting- and open-loop is the next frontier. Fuel retailers that adopt it will unlock new revenue, stronger loyalty, and a competitive edge.

This is your moment to lead the transition, not just react to it. The tools are here. The demand is clear. Now is the time to lead the future of fleet payments- starting today.

Learn more at Picafuel.com